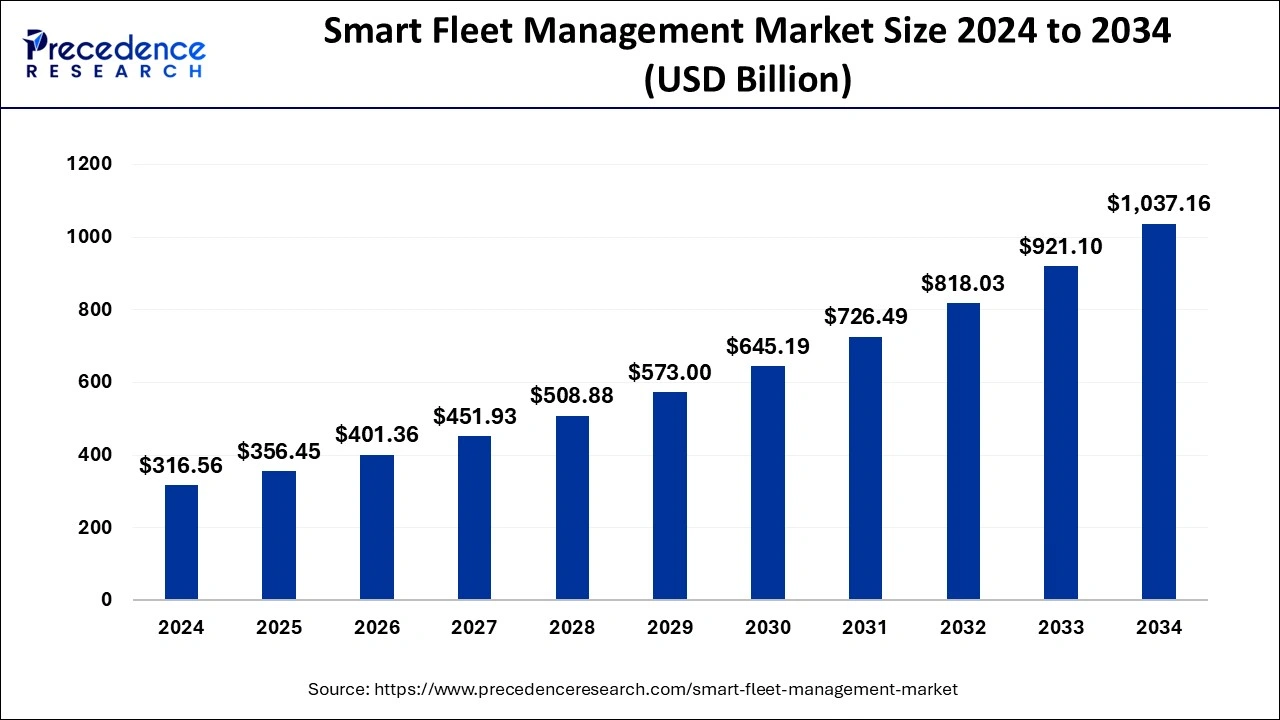

The global smart fleet management market size is expected to attain USD 1,037.16 billion by 2034 from USD 316.56 billion in 2024, growing at a CAGR of 12.6%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1058

Key Points

- With a 40% market share, Asia Pacific led the industry in 2024.

- Among transportation types, the automotive segment secured the highest market share in 2024.

- The ADAS hardware segment is forecasted to grow at a remarkable CAGR throughout the projected period.

AI-Driven Innovations in Smart Fleet Management

- Predictive Maintenance – AI analyzes vehicle performance data to anticipate maintenance needs, reducing downtime and repair costs.

- Route Optimization – AI-powered algorithms determine the most efficient routes in real time, improving fuel efficiency and delivery times.

- Autonomous Fleet Operations – AI facilitates semi-autonomous and fully autonomous fleet management, reducing human error and increasing operational efficiency.

- Enhanced Driver Safety – AI-driven monitoring systems detect driver fatigue and risky behavior, sending real-time alerts to prevent accidents.

- Fuel Efficiency Optimization – AI analyzes driving patterns and vehicle conditions to suggest fuel-saving strategies, cutting operational costs.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 316.56 Billion |

| Market Size in 2025 | USD 356.45 Billion |

| Market Size by 2034 | USD 1,037.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.60% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Hardware, Transportation, Connectivity, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Market Drivers

The growing need for fleet optimization and cost control is driving the adoption of smart fleet management solutions. Businesses are leveraging AI, machine learning, and GPS tracking to improve vehicle utilization, reduce fuel consumption, and enhance driver safety. Governments worldwide are implementing regulations that require fleet operators to adopt technologies such as electronic logging devices (ELDs) and automated compliance tracking systems. The increasing use of autonomous and connected vehicles is further fueling demand for intelligent fleet management solutions.

Market Opportunities

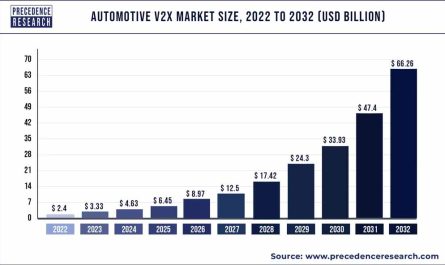

The transition to electric vehicles (EVs) in fleet operations presents a major opportunity for smart fleet management providers. AI-powered predictive maintenance and battery management systems are becoming essential for maximizing EV fleet performance. The growth of e-commerce and last-mile delivery services is also driving the need for fleet efficiency and real-time tracking. The adoption of blockchain in fleet management offers enhanced transparency, reducing fraud and improving logistics management. Additionally, advancements in geospatial analytics and vehicle-to-everything (V2X) communication are expected to transform the industry.

Market Challenges

Smart fleet management faces obstacles such as high initial costs, complex integration with legacy systems, and data security risks. Many businesses hesitate to adopt new technologies due to concerns over ROI and system compatibility. The cybersecurity threat to cloud-based fleet solutions remains a critical issue, as unauthorized access to fleet data can lead to operational disruptions. Additionally, the varying regulatory landscape across different countries makes standardizing fleet management practices a challenge for multinational operators.