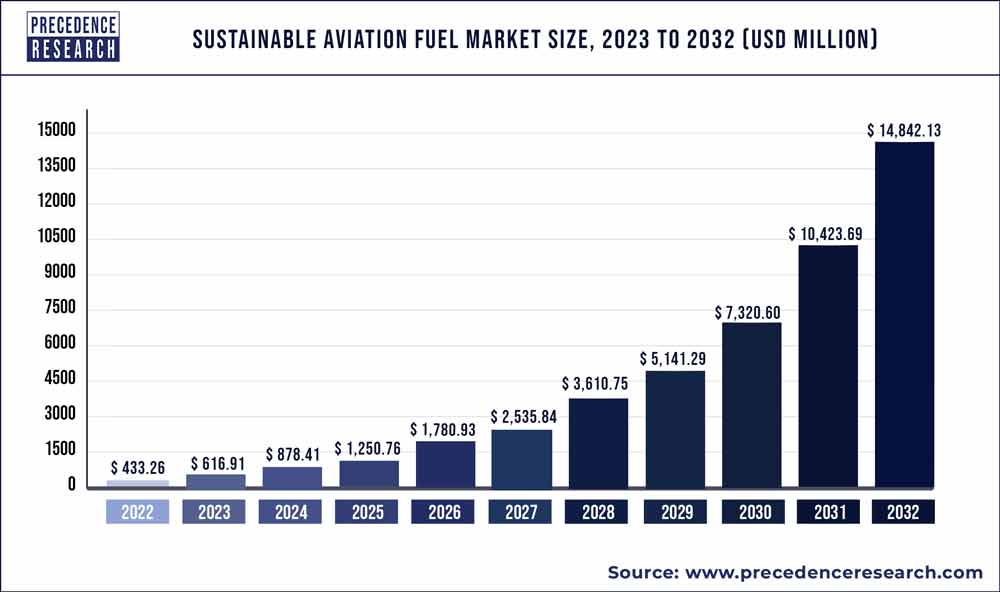

The global sustainable aviation fuel market size reached USD 616.91 million in 2023, and it is projected to hit around USD 14,842.13 million by 2032, expanding at a CAGR of 42.39% from 2023 to 2032.

Key Takeaways

- North America generated maximum market share in 2022.

- Asia-Pacific will reach at a CAGR of 60.1% from 2023-2032.

- The biofuel type segment has captured the major share in 2022 which was 57%.

- The Fischer Tropsch Synthetic Paraffinic Kerosene (FT-SPK) technology segment dominated the market in 2022.

- The military aviation technology aircraft type segment dominated the market in 2022.

- The 30% to 50% biofuel blending capacity segment dominated the market in 2022.

The growing support from various governments and the increasing effectiveness of sustainable aviation fuel is driving the growth of the market for renewable fuels. Furthermore, the rise in air transportation and consumption of chemically synthesized lubricants is driving market expansion. As a result, the rising number of individuals using air transportation aided the market’s development. Furthermore, air travel is critical to economic growth and development, and it contributes to the expansion of trade, tourism, and job opportunities.

The aviation method is expanding and will continue to grow, which will be an important market growth determinant. Increased spending on aircraft infrastructure development by public and private sector participants will also enhance overall growth. Furthermore, continuous R&D in the deployment of progressive innovations will expand the scope of modification.

Get the sample pages of report@ https://www.precedenceresearch.com/sample/2622

Sustainable Aviation Fuel Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 616.91 Million |

| Market Size by 2032 | USD 14842.13 Million |

| Growth Rate from 2023 to 2032 | CAGR of 42.39% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Fuel Type, By Technology, By Biofuel Blending Capacity and By Aircraft Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Sustainable Aviation Fuel Market Dynamics

Drivers: Increase in the use of synthetic lubricants.

Synthetic lubricants offer enhanced energy efficacy, thermal stability, superior performance in extreme conditions, and oxidation resistance, all of which contribute to the expansion of the worldwide sustainable aviation fuel industry. Furthermore, synthetic lubricants provide improved tolerance to frictional wear of costly aircraft structures and longer service life, driving the market to growth. Moreover, companies involved in the production of sustainable aviation fuels have implemented a growth strategy to provide technologically advanced and efficient lubricants, which aid in the expansion of sustainable aviation fuel in the global market.

Restraint: Crude oil price fluctuations

Crude oil cost fluctuations have a direct influence on the production of aircraft fuels. Any rate increase or decrease has an impact on the industry developments for aviation fuels. Any rise in the price of crude oil directly drives up the cost of production for makers. Thus, a surge in crude oil prices further affects airlines, as a flight uses 14 liters of fuel per km on average, increasing operational costs. The added cost of aviation fuels as a result of rising prices for crude oil stifles market growth.

Segment landscape in the global

Technology Landscape

The Fischer Tropsch Synthetic Paraffinic Kerosene (FT-SPK) sector dominated the market in 2022, with a major share. The FTSPK process gasifies coal, natural gas, or biomass feedstocks into syngas of hydrogen and carbon monoxide. This syngas is enzymatically converted into a liquid hydrocarbon fuel mixing component in the FT reactor.

Catalytic Hydro thermolysis Jet (CHJ) is growing at a remarkable rate with a fastest CAGR. In the CHJ process, also known as hydrothermal liquefaction, free fatty acid (FFA) oil obtained from the refining of excess oils or energy oils is blended with preheated feed solution and then transferred to the Catalytic hydro reactor. Under extremely high temperatures and pressure, a single phase of FFA and supercritical water (SCW) is formed. The FFAs are cracked, cyclized, and isomerized into isoparaffin, paraffin, aromatic, and cycloparaffin compounds. Its raw material is vegetable or animal fats, greases, and oils.

Aircraft Type Landscape

Military aviation led the market in 2022, with an 42% in 2022. This increase is the result of an increase in the defense budget as well as various government plans to use sustainable aviation fuel. Military aviation includes transport and fighter planes, as well as rotary-wing planes and unmanned aerial vehicles (UAV).

The regional transport aircraft sector is anticipated to grow at a steady pace from 2023 to 2032 with a strongest CAGR. Regional aircraft are made up of regional jets and turboprops, each of which serves a specific purpose in commercial aviation. The incorporation of innovative and cost-effective technologies in aircraft systems is a significant success factor for makers because it rises the appeal and benefits by improving the inflight passenger experience due to increased comfort and reduced cabin noise levels, as well as less noise within and around airports. Clean Sky’s Regional Aircraft program’s role is to verify the incorporation of innovations onto regional aircraft at an elevated degree of complexity than that attained in the 1 Green Regional Aircraft (GRA) program, to significantly lower the risk of their integration on future developments.

Fuel Type Landscape

The biofuel sector accounted for 53% of the global industry in 2022 and is predicted to continue to dominate throughout the forecast period, owing to governments’ increased focus on addressing the rising levels of greenhouse gas emissions caused by the aviation industry.

The growing demand for renewable aviation fuels is propelling the growth of the power-to-liquid (PtL) segment, which is created by combining hydrogen, which separates from water, with carbon derived from the climate or industrial effluents gas in a process known as electrolysis. PtL is regarded as critical advanced technology for enabling a fully renewable, sustainable, post-fossil fuel aviation fuel source in the long term while mitigating potential risks.

Regional Landscape

North America was the leading market for global sustainable aviation fuel in 2022. North America dominates the market for sustainable aviation fuel due to enhanced air traffic and passengers. Furthermore, the government’s initiatives to encourage the use of sustainable aviation fuels, as well as the accelerated adoption of advanced techniques, contribute to the region’s market growth.

Europe is anticipated to grow at a remarkable pace between 2023 to 2032. The region’s aviation industry is one of the fastest-growing causes of emissions of greenhouse gases that cause climate change, and this is due to the increase in air passenger traffic in 2022. Europe is among the top regions in biofuel manufacturing technologies as of 2022, with a considerable number of manufacturing plants operational. The region’s bio-based aviation fuel manufacturing capacity is based on a small number of plants, with a maximum potential outcome of roughly 2.3 million tons per year.

Read Also: Advanced Aerial Mobility Market Size to Reach US$ 45.12 Bn By 2030

Recent Developments:

- The European Commission published a bundle of legislative proposals termed “Fit for 55” in July 2021. The ReFuelEU proposal, which aims to increase SAF production and uptake, is one component of the package.

- Cepsa approved a contract with Iberia and Iberia Express in January 2022 for the advancement and large manufacture of sustainable aviation fuel. The deal calls for SAF to be produced using recycled oils, waste, as well as plant-based second-generation bio feedstock.

- In partnership with DHL Express, Neste Company revealed the most significant SAF deals ever in March 2022. This agreement is Neste’s most visible SAF and one of the aviation industry’s most crucial sustainable aviation fuel contracts. This collaboration will enhance Neste’s existing web by providing global connectivity.

- In May 2021, the United States Congress initiated the Sustainable Skies Act, which aims to increase incentives for the use of SAF.

- The 77th IATA Annual General Meeting in Boston adopted a resolution for the worldwide aviation industry to accomplish net-zero carbon dioxide emissions by 2050. The above commitment aligned with the Paris Agreement’s aim to limit global warming to 1.5°C. One possible scenario is that SAF will lessen 65% of this.

- Aramco has become an organizational partner of Aston Martin Racing (AMR) for the 2022 Formula 1® season, ushering in a new collaboration in motorsports.

- In 2020, ASTM approved two major specialized SAF certifications, bringing the total number of approved technical SAF production pathways to seven.

Key Market Players

- Northwest Advanced Biofuels, LLC.

- Red Rock Biofuels

- Fulcrum BioEnergy, Inc.

- Aemetis, Inc.

- TotalEnergies SE

- OMV Aktiengesellschaft

- Neste Oyj

- SKYNRG

- Gevo Inc.

- Eni SPA

- Avfuel Corporation

- SG Preston Company

- Sundrop Fuels Inc.

- Ballard Power Systems

- Velocys

- ZeroAvia, Inc.

Segments Covered in the Sustainable Aviation Fuel Market

By Fuel Type

- Biofuel

- Power-to-Liquid

- Gas-to-Liquid

By Technology

- HEFA-SPK

- FT-SPK

- HFS-SIP

- ATJ-SPK

By Aircraft Type

- Fixed Wings

- Rotorcraft

- Others

By Biofuel Blending Capacity

- Above 50%

- 30% to 50%

- Below 30%

By Aircraft Type

- Commercial

- Regional Transport Aircraft

- Military Aviation

- Business & General Aviation

- Unmanned Aerial Vehicles

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com