Key Points

- The U.S. third-party logistics market was valued at USD 219.4 billion in 2022.

- North America led the global market with the highest market share in 2022.

- By Service, the domestic transportation management (DTM) segment has held the highest market share in 2022.

- By End-Use, the manufacturing segment has held the largest revenue share in 2022.

- By Transport, the roadways segment dominated the global market in 2022.

The third-party logistics (3PL) market has emerged as a critical component of supply chain management, providing outsourced logistics and transportation services to companies across various industries. As businesses seek to optimize their operations and focus on core competencies, the demand for 3PL services continues to grow. In this comprehensive analysis, we will delve into the trends, growth factors, regional insights, and competitive landscape of the third-party logistics market.

Get a Sample: https://www.precedenceresearch.com/sample/1256

Growth Factors

Several factors drive the growth of the third-party logistics market globally. Firstly, the increasing complexity of supply chains and the globalization of trade have led companies to seek specialized expertise and resources to manage their logistics operations efficiently. 3PL providers offer expertise in areas such as transportation management, warehousing, freight forwarding, and customs brokerage, enabling companies to streamline their supply chain processes and reduce costs.

Moreover, the rise of e-commerce has fueled demand for 3PL services, as online retailers require efficient and flexible logistics solutions to meet the demands of fast-paced and dynamic markets. 3PL providers play a crucial role in managing inventory, fulfilling orders, and coordinating last-mile delivery, allowing e-commerce companies to scale their operations rapidly and reach customers worldwide.

Additionally, technological advancements have transformed the third-party logistics industry, enabling providers to offer innovative solutions and value-added services to their clients. Technologies such as cloud-based logistics platforms, internet of things (IoT) sensors, and artificial intelligence (AI) algorithms enhance visibility, efficiency, and decision-making across the supply chain, driving demand for 3PL services that can leverage these capabilities effectively.

Trends:

The third-party logistics market is characterized by several notable trends that are shaping the industry’s landscape. One significant trend is the convergence of logistics and technology, as 3PL providers increasingly invest in digital solutions to enhance their service offerings and differentiate themselves in the market. For example, many 3PL companies are leveraging data analytics and predictive modeling to optimize transportation routes, minimize inventory holding costs, and improve overall supply chain performance.

Another key trend is the shift towards integrated logistics solutions, where 3PL providers offer a comprehensive suite of services that span the entire supply chain, from sourcing and procurement to warehousing and distribution. Integrated logistics providers can deliver greater value to their clients by offering end-to-end visibility, coordination, and optimization of logistics processes, enabling companies to achieve greater efficiency and agility in their operations.

Furthermore, sustainability and environmental responsibility are becoming increasingly important considerations in the third-party logistics market. With growing awareness of climate change and environmental degradation, companies are seeking 3PL providers that prioritize sustainable practices and offer eco-friendly transportation options, such as electric vehicles, alternative fuels, and carbon-neutral shipping solutions.

Third-party Logistics Market Scope

| Report Highlights | Details |

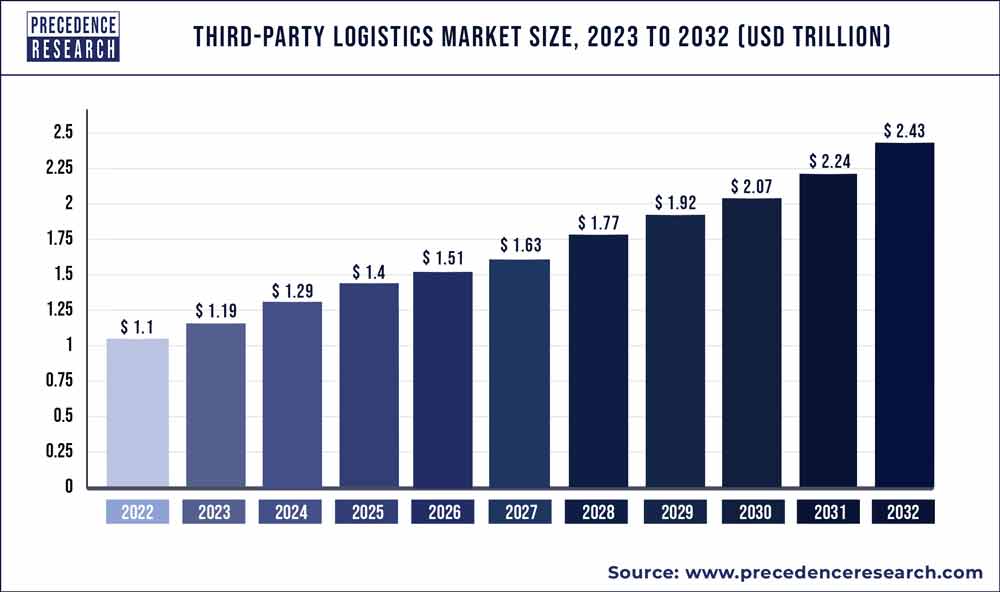

| Growth Rate from 2023 to 2032 | CAGR of 8.25% |

| Market Size in 2023 | USD 1.19 Trillion |

| Market Size by 2032 | USD 2.43 Trillion |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Service, By Transport and By End-use |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Region Insights:

The third-party logistics market exhibits varying dynamics across different regions, influenced by factors such as economic development, infrastructure, and regulatory environment. In mature markets such as North America and Europe, 3PL penetration is relatively high, driven by the presence of established logistics providers, robust transportation networks, and advanced technologies. These regions are characterized by a high degree of outsourcing of logistics functions, with companies relying on 3PL providers to manage their supply chain operations efficiently.

In contrast, emerging markets in Asia-Pacific, Latin America, and Africa offer significant growth opportunities for the third-party logistics industry, fueled by rapid urbanization, industrialization, and e-commerce expansion. Countries such as China, India, Brazil, and Mexico are experiencing strong demand for 3PL services, driven by the need for reliable transportation, warehousing, and distribution solutions to support growing consumer markets and supply chain complexities.

Competitive Landscape: The third-party logistics market is highly fragmented, with numerous global, regional, and niche players competing for market share. Global logistics giants such as DHL, UPS, FedEx, and DB Schenker dominate the industry, leveraging their extensive networks, resources, and technological capabilities to offer a wide range of logistics services to clients worldwide. These companies invest heavily in technology, infrastructure, and talent to maintain their competitive edge and expand their market presence.

At the regional level, local and regional 3PL providers compete based on their understanding of local market dynamics, regulatory compliance, and customer service. Many regional players focus on niche markets or specialized services, such as temperature-controlled logistics, hazardous materials handling, or last-mile delivery, to differentiate themselves and attract clients in specific industries or geographic regions.

Moreover, the third-party logistics market is witnessing increased competition from technology companies and startups that offer innovative logistics solutions powered by digital platforms, automation, and AI. These disruptors are challenging traditional 3PL providers by offering agile, scalable, and cost-effective alternatives to conventional logistics services, driving innovation and transformation in the industry.

Read Also: Intelligent Transportation System Market Size, Report By 2032

Some of the prominent players in the third-party logistics market include:

- Burris Logistics

- CEVA Logistics

- C.H. Robinson Worldwide (CHRW) Inc.

- DB Schenker Logistics

- FedEx Corporation

- BDP International

- UPS Supply Chain Solutions, Inc.

- Kuehne + Nagel International AG

- J.B. Hunt Transport Services, Inc.

- Nippon Express Co., Ltd.

- XPO Logistics, Inc

Segments Covered in the Report:

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Precedence Research has segmented the global third-party logistics market report on the basis of service, transport, end-use, and region:

By Service

-

- Domestic Transportation Management (DTM)

- International Transportation Management (ITM)

- Dedicated Contract Carriage (DCC)/ Freight forwarding

- Value-Added Logistics Services (VALs)

- Warehousing & Distribution (W&D)

By Transport

-

- Railways

- Roadways

- Airways

- Waterways

By End-Use

-

- Retail

- Manufacturing

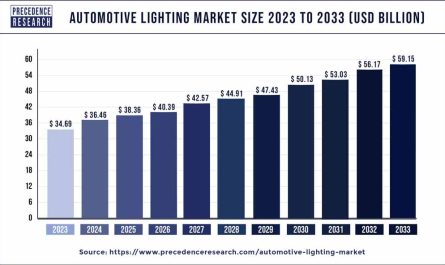

- Automotive

- Healthcare

- Others

By Geography

-

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

- North America

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/