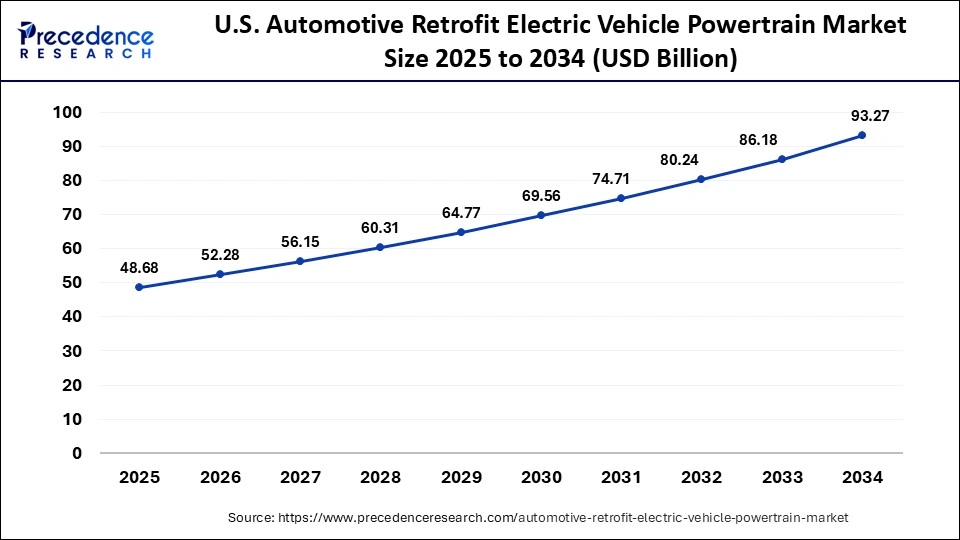

The U.S. automotive retrofit electric vehicle powertrain market size reached USD 64.62 billion in 2023 and is projected to surpass around USD 210.15 billion by 2033 with a noteworthy CAGR of 12.51% from 2024 to 2033.

The U.S. automotive retrofit electric vehicle (EV) powertrain market is experiencing significant growth driven by the increasing adoption of electric mobility solutions. Retrofitting involves converting conventional internal combustion engine (ICE) vehicles into electric vehicles by integrating electric powertrains. This transformation addresses environmental concerns, enhances vehicle efficiency, and meets stringent emission regulations. The market is propelled by the rising demand for sustainable transportation solutions and government initiatives promoting EV adoption.

Get a Sample: https://www.precedenceresearch.com/sample/4258

U.S. Automotive Retrofit Electric Vehicle Powertrain Market Key Points

- By component, the inclusive conversion kit segment dominated the market with the largest market share of 38.12% in 2023.

- By vehicle, the commercial vehicle segment has held a major market share of 47% in 2023.

- By electric vehicle, the all-electric vehicle battery segment has generated more than 39.82% of the market share in 2023.

U.S. Automotive Retrofit Electric Vehicle Powertrain Market Trends

Key trends in the U.S. automotive retrofit EV powertrain market include advancements in battery technology, such as improved energy density and reduced costs, making retrofitting more feasible and efficient. Additionally, there is a growing trend towards modular and scalable powertrain solutions that cater to various vehicle types and sizes. Moreover, the integration of smart technologies and connectivity features in retrofit EV powertrains is enhancing user experience and operational efficiency.

U.S. Automotive Retrofit Electric Vehicle Powertrain Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.51% |

| U.S. Automotive Retrofit Electric Vehicle Powertrain Market Size in 2023 | USD 64.62 Billion |

| U.S. Automotive Retrofit Electric Vehicle Powertrain Market Size in 2024 | USD 75.93 Billion |

| U.S. Automotive Retrofit Electric Vehicle Powertrain Market Size by 2033 | USD 210.15 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Vehicle, and By Electric Vehicle |

Component Insights

The market is segmented by various components essential for retrofitting vehicles with electric powertrains. This includes electric motors, battery packs, power electronics (inverters and converters), wiring harnesses, and battery management systems. Each component plays a crucial role in converting internal combustion engine vehicles into electric ones, ensuring optimal performance and efficiency.

US EV Retrofit Market Revenue (US$ Bn), By Component

| By Component | 2019 | 2020 | 2021 | 2022 | 2023 |

| Inclusive Conversion Kit | 11.87 | 14.89 | 7.93 | 20.99 | 24.64 |

| Electric Motor​ | 5.70 | 7.14 | 8.58 | 10.03 | 11.74 |

| Battery​ $6.72 | 6.72 | 8.40 | 10.07 | 11.74 | 13.72 |

| Controller​ | 2.88 | 3.60 | 4.31 | 5.02 | 5.87 |

| Charger​ $0.83 | 0.83 | 1.04 | 1.24 | 1.44 | 1.67 |

| Others (Axle, Converter)​ | 3.50 | 4.35 | 5.19 | 6.01 | 6.98 |

Vehicle Type Insights

Retrofit electric powertrains cater to a wide range of vehicle types, including passenger cars, light commercial vehicles, and even larger trucks or buses. Each vehicle type presents unique challenges and opportunities in terms of powertrain adaptation, battery placement, and overall performance requirements.

- In February 2024, ZF stated that its Gray Court, South Carolina, manufacturing site saw the first PowerLine 8-speed automatic gearboxes come off the line in late 2023. ZF is currently increasing output to 200,000 gearboxes annually by 2025 as part of a $200 million investment announced in 2021 to meet demand from US commercial vehicle manufacturers, including three US-based clients.

Electric Vehicle Specifics Insights

In terms of electric vehicle specifics, the market focuses on retrofit solutions that enhance vehicle range, charging capabilities, and overall efficiency. This segment includes advancements in battery technology, integration of regenerative braking systems, and development of smart charging solutions. Moreover, government regulations and incentives play a significant role in shaping this segment, encouraging adoption through financial support and policy frameworks.

U.S. Automotive Retrofit Electric Vehicle Powertrain Market Dynamics

Drivers

Several drivers propel the growth of the U.S. automotive retrofit EV powertrain market, including increasing environmental awareness, rising fuel costs, and favorable government policies promoting zero-emission vehicles. Fleet operators and logistics companies are increasingly opting for retrofitting to reduce operational costs and comply with sustainability goals. Moreover, technological advancements and partnerships between automakers, technology providers, and battery manufacturers are accelerating market growth.

Opportunities

The market presents ample opportunities for innovation and investment in battery recycling technologies, charging infrastructure development, and software solutions for optimized powertrain performance. As consumer demand for electric vehicles continues to rise, there is a burgeoning market for aftermarket retrofit kits and services, offering customization options and enhanced vehicle functionalities. Furthermore, collaborations between automotive OEMs and retrofitting specialists create opportunities for scaling up production and expanding market reach.

Challenges

Despite its growth prospects, the U.S. automotive retrofit EV powertrain market faces challenges such as high initial costs of retrofitting, concerns regarding vehicle warranty and safety standards, and the need for skilled technicians capable of performing complex conversions. Regulatory uncertainties and variability in government incentives across different states also pose challenges for market participants. Addressing these challenges requires continuous innovation, standardized conversion processes, and partnerships across the automotive ecosystem.

Read Also: Industrial Vehicle Market Size to Cross USD 65.60 Bn by 2033

U.S. Automotive Retrofit Electric Vehicle Powertrain Market Recent Developments

- In October 2022, Bosch began producing electric motors for Rivian at its Charleston, South Carolina factory, replacing fuel injectors.

- In September 2022, Bosch launched a new electric drive for light commercial vehicles, a compact drive module with an electric motor and inverter.

U.S. Automotive Retrofit Electric Vehicle Powertrain Market Companies

- A123 Systems LLC

- Enginer

- EVdrive

- Hybrid Design Services

- Zero Labs automotive

Segments Covered in the Report

By Component

- Inclusive Conversion Kit

- Electric Motor

- Battery

- Controller

- Charger

- Others

By Vehicle

- Two Wheelers

- Passenger vehicles

- Commercial vehicle

By Electric Vehicle

- All Electric Vehicle Battery

- Plug-in-hybrid Vehicle

- Hybrid Vehicle

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/