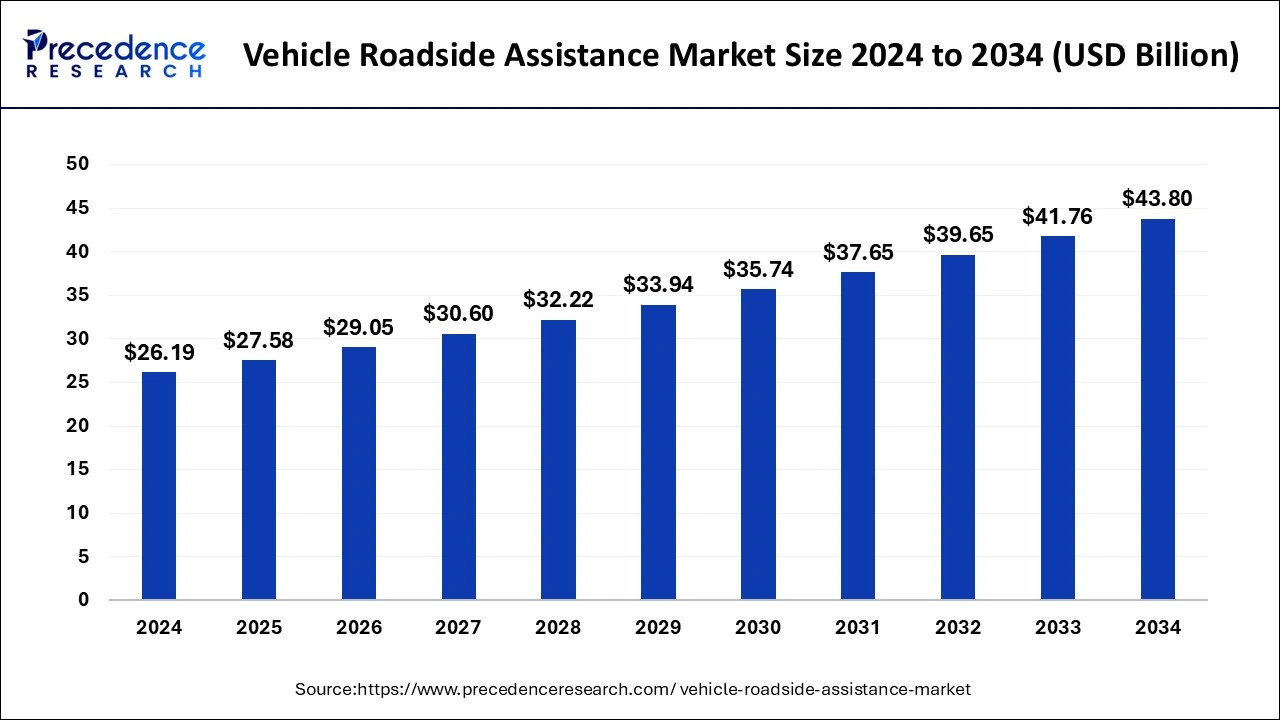

The global vehicle roadside assistance market size was evaluated at USD 26.19 billion in 2024 and is predicted to gain around USD 43.80 billion by 2034 with a CAGR of 5.27%.

Get sample Copy Of Report @ https://www.precedenceresearch.com/sample/1006

Market Key Takeaways

- With a 38% revenue share, Europe emerged as the leading regional market in 2024.

- The towing service segment held the largest market share among services in 2023.

- The auto manufacturer segment is anticipated to lead the provider landscape in the forecast period.

- Passenger vehicles continue to be a major revenue-generating segment in the industry.

AI Impact on the Vehicle Roadside Assistance Market

AI is transforming the vehicle roadside assistance market by enhancing efficiency, response times, and customer experience. AI-powered chatbots and virtual assistants streamline service requests, providing real-time assistance and reducing wait times. Predictive analytics help prevent breakdowns by analyzing vehicle data and identifying potential failures before they occur. AI-driven GPS tracking and route optimization ensure faster dispatch of tow trucks and service providers, improving response efficiency. Additionally, machine learning enhances fraud detection, ensuring fair and reliable service. As AI technology continues to evolve, it will play a crucial role in making roadside assistance smarter, faster, and more proactive.

AI Impact on the Vehicle Roadside Assistance Market

AI is transforming the vehicle roadside assistance market by enhancing efficiency, response times, and customer experience. AI-powered chatbots and virtual assistants streamline service requests, providing real-time assistance and reducing wait times. Predictive analytics help prevent breakdowns by analyzing vehicle data and identifying potential failures before they occur. AI-driven GPS tracking and route optimization ensure faster dispatch of tow trucks and service providers, improving response efficiency. Additionally, machine learning enhances fraud detection, ensuring fair and reliable service. As AI technology continues to evolve, it will play a crucial role in making roadside assistance smarter, faster, and more proactive.

Vehicle Roadside Assistance Market Overview

The vehicle roadside assistance market is growing significantly due to the rising number of vehicles on the road and increasing demand for quick, reliable breakdown support services. Consumers are seeking efficient solutions for emergencies such as flat tires, battery failures, fuel shortages, and towing needs. The market includes various service providers, including auto manufacturers, insurance companies, and third-party assistance firms. With advancements in technology, AI-driven predictive maintenance and GPS tracking are enhancing the efficiency of roadside services. The growing adoption of electric vehicles (EVs) has further fueled the demand for specialized roadside assistance, such as mobile EV charging solutions.

Market Drivers

Several factors are driving the expansion of the roadside assistance market. The rising vehicle population, especially in emerging economies, has increased the demand for emergency breakdown services. Additionally, growing consumer preference for convenience and safety has led to higher adoption of roadside assistance plans. Automakers and insurance providers are integrating roadside assistance services as part of their customer benefits, further propelling market growth. The use of AI, IoT, and telematics is improving response times and service efficiency, making roadside assistance more accessible and effective.

Market Opportunities

The integration of AI and predictive analytics in roadside assistance presents significant opportunities for market growth. AI-powered diagnostics can help predict vehicle failures, reducing the frequency of unexpected breakdowns. The increasing shift towards electric vehicles (EVs) is creating a demand for specialized roadside support, such as mobile EV charging stations. Additionally, expanding subscription-based roadside assistance programs among fleet operators and ride-sharing companies presents a lucrative market opportunity. Digital platforms and mobile apps are also playing a crucial role in improving service accessibility and customer experience.

Market Challenges

Despite its growth potential, the market faces several challenges. High operational costs associated with maintaining a network of service providers and infrastructure can limit expansion. The increasing complexity of modern vehicles, particularly electric and connected cars, requires specialized training for service providers, adding to the overall cost burden. Cybersecurity concerns related to connected roadside assistance platforms also pose a risk, as data breaches could compromise customer information and vehicle diagnostics. Additionally, inconsistent service availability in rural and remote areas remains a key challenge.

Regional Insights

The North American market is well-established, driven by strong automotive sales, high vehicle ownership, and a well-developed roadside assistance network. Europe holds a significant market share, with auto manufacturers and insurance companies offering roadside services as a standard feature. The Asia-Pacific region, led by countries like China, India, and Japan, is experiencing rapid growth due to increasing vehicle sales and expanding highway networks. In Latin America and the Middle East & Africa, market growth is steady, with rising vehicle ownership and improvements in roadside assistance infrastructure. However, service accessibility remains a challenge in certain remote areas.

Vehicle Roadside Assistance Market Companies

- Viking Assistance Group AS

- ARC Europe SA

- Swedish Auto

- SOS International A/S

- Allianz Global Assistance

- Falck A/S

- Allstate Insurance Company

- AAA

- Agero, Inc.

- Best Roadside Service

- AutoVantage

- Roadside Masters

- Paragon Motor Club

- Good Sam Enterprise, LLC

- Access Roadside Assistance

- Better World Club

- Emergency Road Services Corporation

- Honk technologies

- National General Insurance

- span wings

- LY INC.

- Twenty Four OTR Pvt Ltd

- TVS Auto Assist India Limited

- ASSURANT, INC.

- RESCUE Vehicle Services Private Ltd.

- Emirates Insurance Co. (PSC)

- CHUBB LIMITED

- Prime Assistance Inc.

- Arabian Automobile Association

Latest Announcement by Industry Leaders

- Vimal Singh SV, Founder & CEO of ReadyAssist, commented that their partnership with RunR Mobility will enable them to cater to more customers in their need for their tech-enabled services across touchpoints in India. He also said that the company aims to contribute to the partner’s growth trajectory while envisioning their own expansion route.

Recent Developments

- In December 2024, Motive announced the launch of Motive Roadside Assistance with a comprehensive 24/7/365 roadside support service to improve driver safety and operational efficiency. The AI-powered platform will provide help faster and even in remote areas.

- In September 2024, AUTO i Care announced the expansion its after-sales and roadside assistance services to cover electric two-wheelers across India. The expansion was made to address the increasing need for reliable after-sales support in the growing EV market.

- In July 2024, Maruti Suzuki announced the expansion of its roadside assistance services to two-wheeler vehicles. The Quick Response Team (QRT) aims to reduce the time taken to reach a stranded vehicle.

Segments Covered

By Service

- Tire Replacement

- Towing

- Jump Start/Pull Start

- Fuel Delivery

- Lockout/Replacement Key Service

- Battery Assistance

- Winch

- Trip Routing/Navigational Assistance

- Other Mechanic Service

By Provider

- Motor Insurance

- Auto Manufacturer

- Automotive Clubs

- Independent Warranty

By Vehicle

- Commercial Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Passenger Vehicles

- Hatchback

- Sedan

- Utility Vehicles

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Ready for more? Dive into the full experience on our website @ https://www.precedenceresearch.com/